Other Resources

The Indian Land Tenure Foundation and its grantees and partners continue to develop new ways to create awareness about ILTF’s mission, to educate Indian people, including youth, about Indian land tenure issues and to share information about trust land management. Various resources are outlined below.

American Indian Homelands: Matters of truth, honor and dignity-immemorial

Produced in 2005. the documentary is hosted and narrated by journalist Sam Donaldson of ABC television and features Senator John McCain (R-Ariz.), former Senator Tom Daschle (D-S.D.), and the late Elouise Cobell, lead plaintiff in the Supreme Court case Cobell v. Salazar. The film has been described as the most compelling and powerful documentary ever produced about the degree to which American Indians have been unjustly treated in respect to their lands and resources, how those injustices occurred, and the devastating consequences of these actions that Indian people still experience today.

Click the link below to watch the film which is now available free of charge on YouTube.

Host: Sam Donaldson

Executive Producer: Barry ZeVan

Co-Producers: Cris Stainbrook & Barry ZeVan

Editor and Director of Photography: Brad Johnson

Director, Writer and Production Designer: Barry ZeVan

Run time: 78 minutes

A VanBar Productions film, in association with the Indian Land Tenure Foundation

Online Landowner Resources

Webinars & Talk Shops

- Your Definitive Introduction to the Fee to Trust Process

- The Origins of the Doctrine of Discovery and its Implications for Indian Country Today

- Understanding the BLM GLRO Database

- Updates from the Land Buy Back Program

The Indian Land Tenure Foundation hosted the webinar, “Updates on the Land Buy-Back Program,’ on Wednesday, July 14th. With Nichlas Emmons, Program Officer at the Indian Land Tenure Foundation moderating, Julius Snell from the Land Buy-Back Program presented updates about the LBBP including context on the program’s background, current results, and implementation schedule.

The Indian Land Tenure Foundation hosted the webinar, “Negotiating Rights-of-Way on Tribal Lands,” on Wednesday, August 18. This webinar will explore issues related to negotiating rights-of-way on tribal lands. Participants will better understand current events, best practices, applicable federal laws and regulations, and rights-of-way valuations, easements, and management.

Margaret Schaff Attorney, Margaret Schaff & Associates, LLC in Boulder, Colorado

Ms. Schaff has over 30 years of experience in tribal legal codes, utility negotiations, electric power and transmission contracting, oil and gas, tribal energy resource development, and rights-of-way.

The webinar is moderated by Nichlas Emmons, Program Officer with the Indian Land Tenure Foundation.

Hosted by Nichlas Emmons, Katie Free, Sarah Lawson, Andrew Orosco, Jr., and Brenda Tomaras, this Talk Shop with Tribal Land Staff focuses on rights-of-way on tribal lands.

This second webinar on the fee-to-trust process focuses on post-submission, the National Environmental Policy Act (NEPA), and surveying.

This webinar is hosted by Nichlas Emmons, Sarah Lawson, Brenda Tomaras, and Karen Woodard.

This third webinar on the fee-to-trust process focuses on acceptance and conveyance and scenarios and solutions.

This webinar is hosted by Nichlas Emmons, Andrew Orosco, Jr., Brenda Tomaras, and Karen Woodard.

Hosted by Nichlas Emmons, Erick Giles, Sarah Lawson, and Brenda Tomaras, this Talk Shop with Tribal Land Staff focuses on the fee-to-trust process.

Hosted by Ryan Barton, Nichlas Emmons, Erick Giles, Sarah Lawson, Andrew Orosco, Jr., Brenda Tomaras, and Karen Woodard, this Talk Shop with Tribal Land Staff focuses on the fee-to-trust process.

This webinar introduces land staff and professionals to new ways of identifying land management issues and overcoming barriers to tribal land management.

The presenter is Amy Wilson, Founder and Principal Consultant for SEE Renewal and hosted by Nichlas Emmons, Program Officer with the Indian Land Tenure Foundation.

This webinar introduces participants to big-picture planning, emphasizing small, incremental steps to the planning process. It will also cover the role of value engineering in the design process. There will be opportunities during the webinar for audience members to ask questions.

This webinar is presented by Ken Ryan, Principal at KTGY, and hosted by Nichlas Emmons of the Indian Land Tenure Foundation.

Hosted by Russell Bellamy, Nichlas Emmons, Sarah Lawson, Karen Woodard, and Katie Yates Free, this Talk Shop with Tribal Land Staff focuses on land appraisals.

This webinar provides viewers with an overview of cadastral surveys, their process and purpose, and relevant case studies.

Hosted by Nichlas Emmons, Program Officer with the Indian Land Tenure Foundation, this webinar is presented by Jacob Barowsky and Christopher McDonald, both with the United States Bureau of Land Management.

Tribal governments are constantly working with other jurisdictions on matters related to land management, including rights-of-way, leasing, and land acquisition. This webinar explores strategies relating to the negotiations between tribal and non-tribal entities and applies to tribal land professionals, tribal leadership, and tribal attorneys.

Hosted by Nichlas Emmons, Program Officer with the Indian Land Tenure Foundation, this webinar is presented by Pablo Padilla, Aaron Sims, Casey Douma, and Justin Solimon, attorneys working on various legal questions on Indian life.

This Talk Shop session provides participants with an overview of the proposed fee-to-trust regulations in preparation to submit comments to tribal leaders.

Hosted by Nichlas Emmons, Program Officer with the Indian Land Tenure Foundation, this webinar is presented by members of the National Tribal Land Association’s Board of Directors.

Surveys are vital in managing Indian land, and tribal land professionals must be prepared for the surveying process. In this webinar, Jacob Barowsky and Christopher McDonald from the Bureau of Land Management (BLM) discuss how tribal land managers can prepare for the survey process. While this session will focus more on BLM surveys, the presenters will also discuss the differences between BLM surveys and private surveys.

Join Jeff Keohane and Karen Woodard as they introduce you to adopting HEARTH Act leasing regulations and its approval by the Bureau of Indian Affairs. Participants will also hear about one tribal nation’s experiences in submitting and implementing these regulations concerning land use planning for future economic development plans.

Land Tenure Glossary

Alienated Land

- Land that has had its ownership transferred to another party.

Allotted Land

- Reservation land the federal government distributed to individual Indians, generally in 40-, 80-, and 160-acre parcels.

Allottee

- An individual who owns an undivided interest in a parcel of allotted land.

Beneficial Use

- The right to benefit from (live on, use, profit from) a parcel of land, the legal title to which is held by the trustee. In the case of Indian land, the trustee is the federal government.

Chain of Title

- A report of the ownership history from the government allotment or trust patent to the current owners.

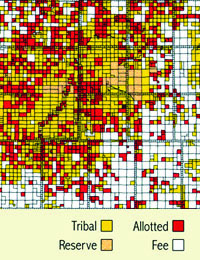

Checkerboarding

- Lands within reservation boundaries may be in a variety of types of ownership – individual Indian, non-Indian, as well as a mix of trust and fee lands. The pattern of mixed ownership resembles a checkerboard.

Escheat

- The reversion of the property of a deceased person to the government when there are no legal heirs.

Fee Simple (Fee Land)

- Land ownership status in which the owner holds title to and control of the property. The owner may make decisions about land use or sell the land without government oversight.

Fee-to-Trust Conversion

- When original allotted trust lands that were transferred to fee land status are returned to trust status. Tribes or individual Indians can initiate the process on fee lands they already own or lands they acquire. In general, this conversion can take as much as two years.

Forced Fee Patents

- A trust-to-fee conversion without the request, consent, or knowledge of the landowner. Forced fee patents led to the loss of many land parcels through tax foreclosure sales.

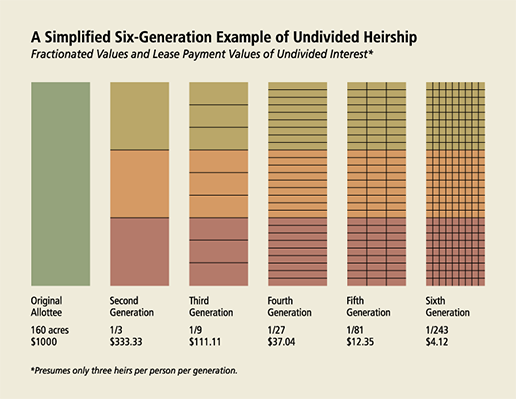

Fractionated Ownership (Fractionation)

- When a trust parcel is owned by more than one owner as undivided interests. Fractionated ownership results from ownership interests being divided again and again when an owner of the interest dies without a will providing for the distribution of the asset. Trust parcels with fractionated ownership often have hundreds, sometimes thousands, of owners. By law, a majority of owners must agree to a particular use of the land, making it difficult for any one of the owners to use the land (i.e. for farming, building a home or starting a business).

Indian Land Tenure

- The terms and conditions by which Indians hold land.

Indian Landowner

- Any tribe or individual Indian who owns an interest in Indian land in trust or restricted status.

Individual Indian Money Account (IIM Account)

- Fund account administered by the Department of the Interior. Funds deposited into these accounts come from a number of sources, including land-related income from leases, timber harvest and mineral extraction on Indian land. In general, each Indian person with an undivided interest in trust land holds an IIM Account.

Interest

- When used with respect to Indian land, an interest is an ownership right to the surface estate of Indian land that is unlimited or uncertain in duration. This includes life estates.

Intestate

- Leaving no legally valid will.

Joint Tenancy with the Right of Survivorship

- When land is owned with other parties as joint tenants and the right to the land lasts as long as each joint tenant is alive. As each joint tenant dies, the surviving joint tenants receive the share of the deceased joint tenant. Eventually, the last surviving joint tenant owns the entire interest in the land, and only that person can decide who gets the land after that remaining tenant dies.

Land Rights

- Although we often speak of people “owning land,” in an American legal context it is more correct to say that people have obtained rights to inhabit and use land. American jurisprudence has slowly evolved to consider property as not the physical object but as a “bundle of rights” composed as legal relationships such as the “right to sell” or “right to devise.” Usually, these rights or legal relations have economic or sale value if they are allowed to be transferred. In American law, the rights to inhabit and use land can be gained by conquest, decree, sale, lease, easement, escheat, patent, or by other agreement. The rights held by one individual may be conveyed to one or more other individuals. The rights to the surface of the earth may be held by different individuals than those who have the rights to the space above (super-surface) and the material below the surface (subsurface) of the earth. Furthermore, the rights to the surface, subsurface, and super-surface may each be shared by many individuals. Most rights are conveyed by a written instrument which evidences a transaction in which any interest in land is created, alienated, mortgaged, or assigned. However, it is important to note that, while different Native people may treat and use land very differently, the concept that people inhabit but do not own the land is still a part of Native American culture. The following quote from the Kickapoo prophet Kanekuk is a good example of this philosophy: “Some of our chiefs make the claim that the land belongs to us. It is not what the Great Spirit told me. He told me that the land belongs to him, that no people own the land…”

Life Estate

- The right to live on, use, and take income from land during a person’s lifetime.

Off-Reservation Trust Land

- Land outside the boundaries of a reservation that is protected by the federal government for Indian use. For example, these pieces of land could be religious sites or pieces allotted to individuals out of the public domain.

Ownership in Severalty

- Rights to land that are owned by one individual.

Patents-in-Fee

- The “patent” is the title deed by which the federal government conveys or transfers land to people. “In fee” refers to the fee simple ownership in land. The term “patent-in-fee” describes the title document issued by the U.S. Federal Government to terminate the trust created by the trust patent issued to the allottee. The patent-in-fee operates to vest fee simple ownership in an allottee or their heirs.

Probate

- The process by which property is transferred from a deceased property owner to his or her heirs and/or beneficiaries. Under the General Allotment Act, a tribe’s traditional rules of descent and property transfer were replaced by the probate laws of the territory or state in which the tribal member resided or where the property was located. This is still the case when an Indian landowner dies without having written a will or when there is no tribal probate code. The Office of Hearings and Appeals (OHA) is responsible for the probate of trust property owned by deceased Native Americans and examines federal law, federal regulations, tribal law, and state law to determine the heirs and/or beneficiaries, the validity of wills, and the validity of claims.

Remainder Interest

- If a person owns a remainder interest in land, his or her right to the land begins when the person owning the life estate in the land dies. If an Indian has the remainder interest, the land stays in trust. To prevent Indian lands from passing out of trust status, non-Indian heirs will only receive a life estate in Indian lands. Because a non-Indian heir owns less than the full interest, a “remainder interest” is created, and this remainder interest must go to an Indian. If there are no such heirs, the remainder may be purchased by any Indian co-owner of the parcel. If no offer is made to purchase the parcel, the remainder interest passes to the tribe. The rules are applicable to both testate and intestate Indian estates.

Restricted Fee Land

- The ownership is the same as fee simple land, but there are specific government-imposed restrictions on use and/or disposition.

Tenancy in Common

- The most common form of ownership of rights to land held in trust for Native Americans. Tenants in common have unity of possession, which means that every owner has an equal right with their co-owners to the land as long as they live. A tenant in common has an undivided interest in the whole property as if they were the sole owner, and can transfer their interest by gift, sale or will. A tenant in common can also decide who will own their interest when they pass away.

Testamentary Disposition

- Property bequeathed or set out in a will.

Testate

- Having made a legally valid will.

Testate Succession

- The transfer of property according to a legally valid will.

Title Status Report (TSR)

- Also referred to as an Interest Report Simple or Interest Report, a TSR takes the place of a title commitment for land that is held in trust. The TSR is a necessary precursor to issuing a mortgage for a property on trust land.

Tribally-Owned Land

- Land that is owned by a group of Indians recognized by the federal government as an Indian tribe.

Trust Land

- Land owned either by an individual Indian or a tribe, the title to which is held in trust by the federal government. Most trust land is within reservation boundaries, but trust land can also be off-reservation, or outside the boundaries of an Indian reservation.

Trust Patent

- Individual Indian allottees were issued documents called “trust patents” to verify that their land was held in trust by the government.

Trust-to-Fee Conversion

- The conversion of lands held in trust by the U.S. Federal Government to fee simple status. With the passage of the Burke Act of 1906, Indian lands held in trust were converted to fee status if the Secretary of the Interior determined that the Indian landowner was competent. Today, trust lands can be converted to fee status in 30 days. Only individual Indian landowners can request a trust-to-fee conversion.

Undivided Interest

- A share of the ownership interest in a parcel of trust land. The number of interests grows with the division among heirs of these interests according to federal or tribal

Usufruct

- The legal right to use or profit from another’s property.

Multimedia

When Rivers Were Trails video game

This engaging educational video game was developed in 2019 by ILTF in collaboration with Michigan State University’s Games for Entertainment and Learning Lab, with funding by the San Manual Band of Mission Indians. More than 20 Indigenous artists were involved in developing the game which teaches students about the impact of allotment acts on Indigenous peoples.

Players follow an Anishinaabeg in the 1890’s who is displaced from Fond du Lac in Minnesota to California. They are challenged to balance their physical, emotional, mental, and spiritual well-being with foods and medicines while making choices about contributing to resistances as well as trading with, fishing with, hunting with, gifting, and honoring the people they meet as they travel through Minnesota, the Dakotas, Montana, Idaho, Washington, Oregon, and eventually must find a place to call home in California.

When Rivers Were Trails is available via the AppStore and Google Play. PC and Mac users can download it from https://indianlandtenure.itch.io/when-rivers-were-trails

Rights-of-Way on Indian Land Webinar

Hosted by ILTF in August of 2021, this webinar explores issues related to negotiating rights-of-way on tribal lands. It covers current events, best practices, applicable federal laws and regulations, and rights-of-way valuations, easements, and management.

Tribe-Specific Curriculum

In 2008, ILTF funded the adaptation of the K-12 Lessons of Our Land curriculum to reflect Montana tribal histories and cultures and to implement the curriculum in classrooms state-wide. Key components of the project included video interviews of tribal members and elders, and other interactive classroom materials, such as a Tribal Lands Jeopardy game.

Click the image above to see an interview with Francis Auld, cultural preservation officer for the Confederated Salish and Kootenai Tribes

University of Montana, Touchscreen Project

Indian Land Tenure Foundation developed an interactive, touchscreen display that is housed in the common area of University of Montana’s Payne Family Native American Center. The display provides a glimpse into the history of Indian land ownership in the U.S. as well as offering information on the key Indian land tenure issues facing Native people today. It also includes a section on Montana Indian Nations, including maps of each of the state’s seven reservations.

Learn more about the Payne Family Native American Center